Event-Driven

Merger Arbitrage

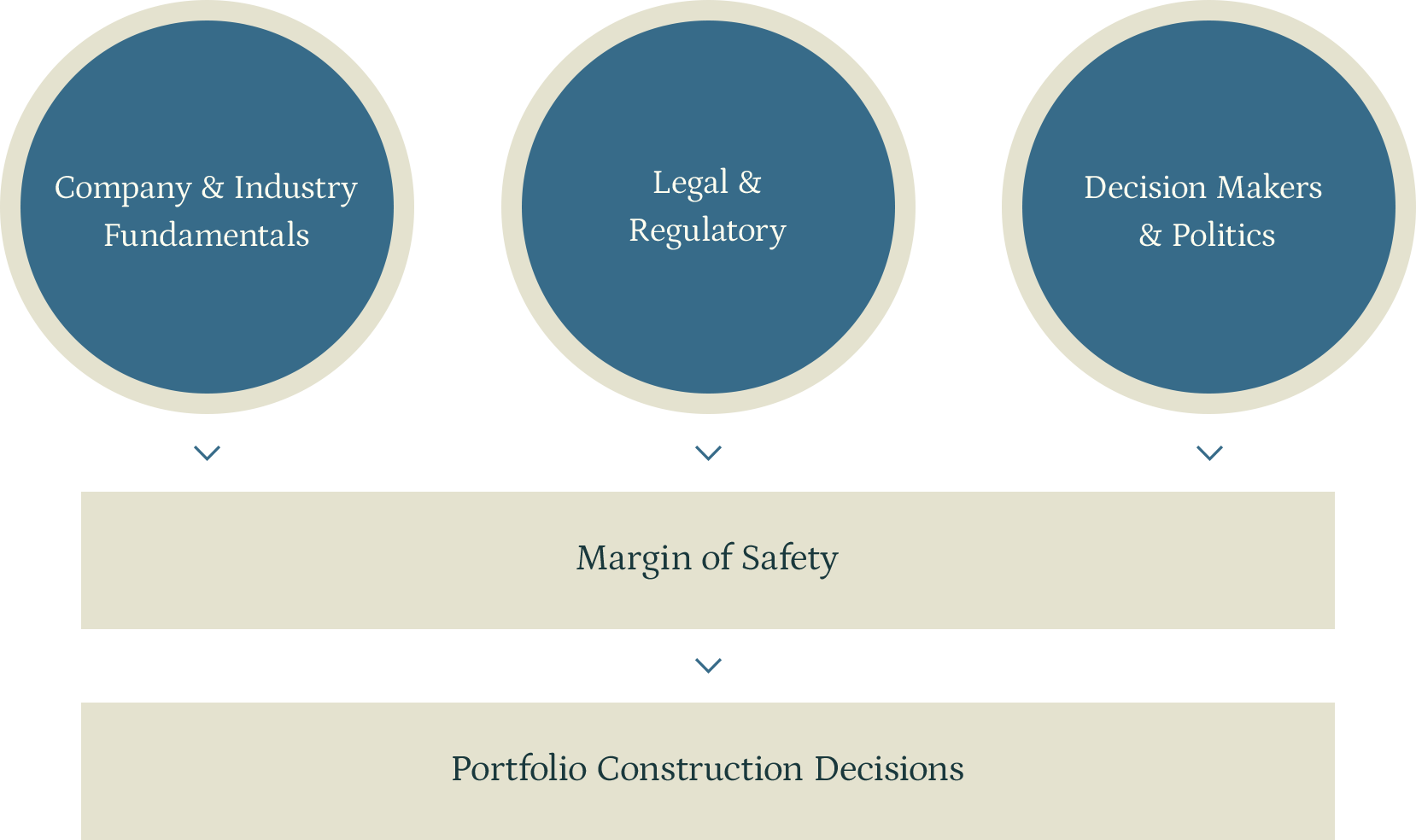

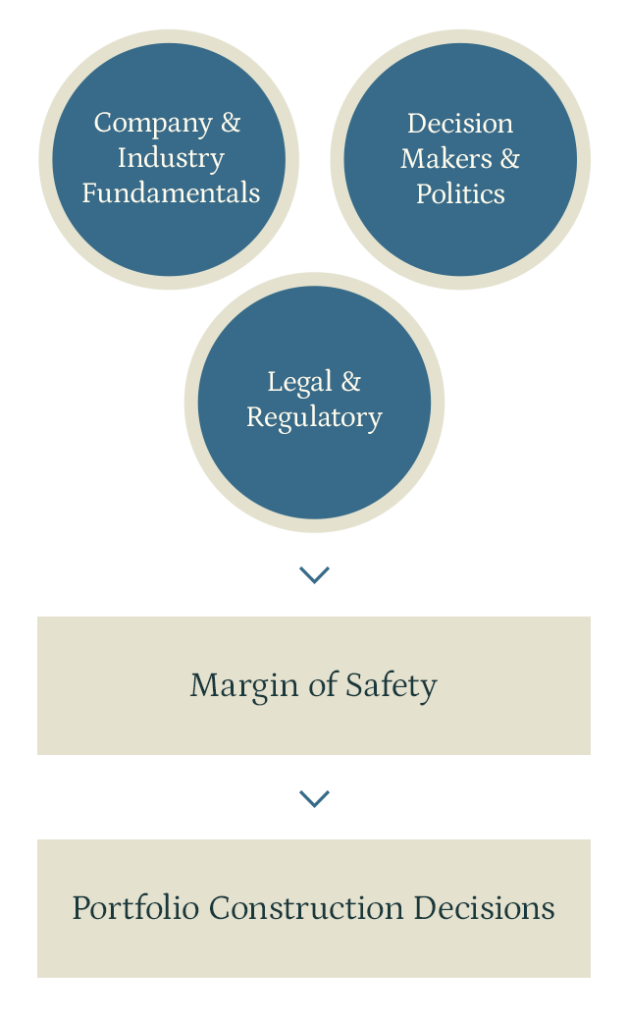

Taconic’s global arbitrage strategy focuses on combining in-depth legal and regulatory knowledge with fundamental analysis to create consistently attractive risk-adjusted returns. We employ a probabilistic approach to traditional merger arbitrage and pre-event situations. We also invest in share class arbitrage and holdco structures.

Investment Process

Catalyst-Driven Equities

Bottom-up, fundamental research-driven approach which seeks to capitalize on idiosyncratic situations with defined catalysts, events, or other forms of corporate change and/or complexity.

- Spinoffs and Splits

- Post-reorganization Equities

- Litigation Outcomes

- Other Opportunistic Equities